Chanel’s Digital Marketing Strategy in China: Mastering Xiaohongshu and Tmall

Introduction

China’s luxury market, projected to account for over 50% of global luxury sales by 2025, is a critical battleground for brands like Chanel. With a digitally savvy consumer base, particularly Millennials and Gen Z, Chanel has crafted a sophisticated digital marketing strategy to engage affluent Chinese consumers. Central to this strategy is Xiaohongshu, often referred to as “Little Red Book” or “Rednote,” a platform blending social media, e-commerce, and user-generated content (UGC). Additionally, Chanel’s presence on Alibaba’s Tmall Luxury Pavilion, combined with the strategic “Red Cat” partnership between Xiaohongshu and Tmall, enhances its e-commerce potential. This article explores Chanel’s digital marketing tactics in China, focusing on Xiaohongshu, the Xiaohongshu-Tmall partnership, and the potential for Chanel to expand on Tmall.

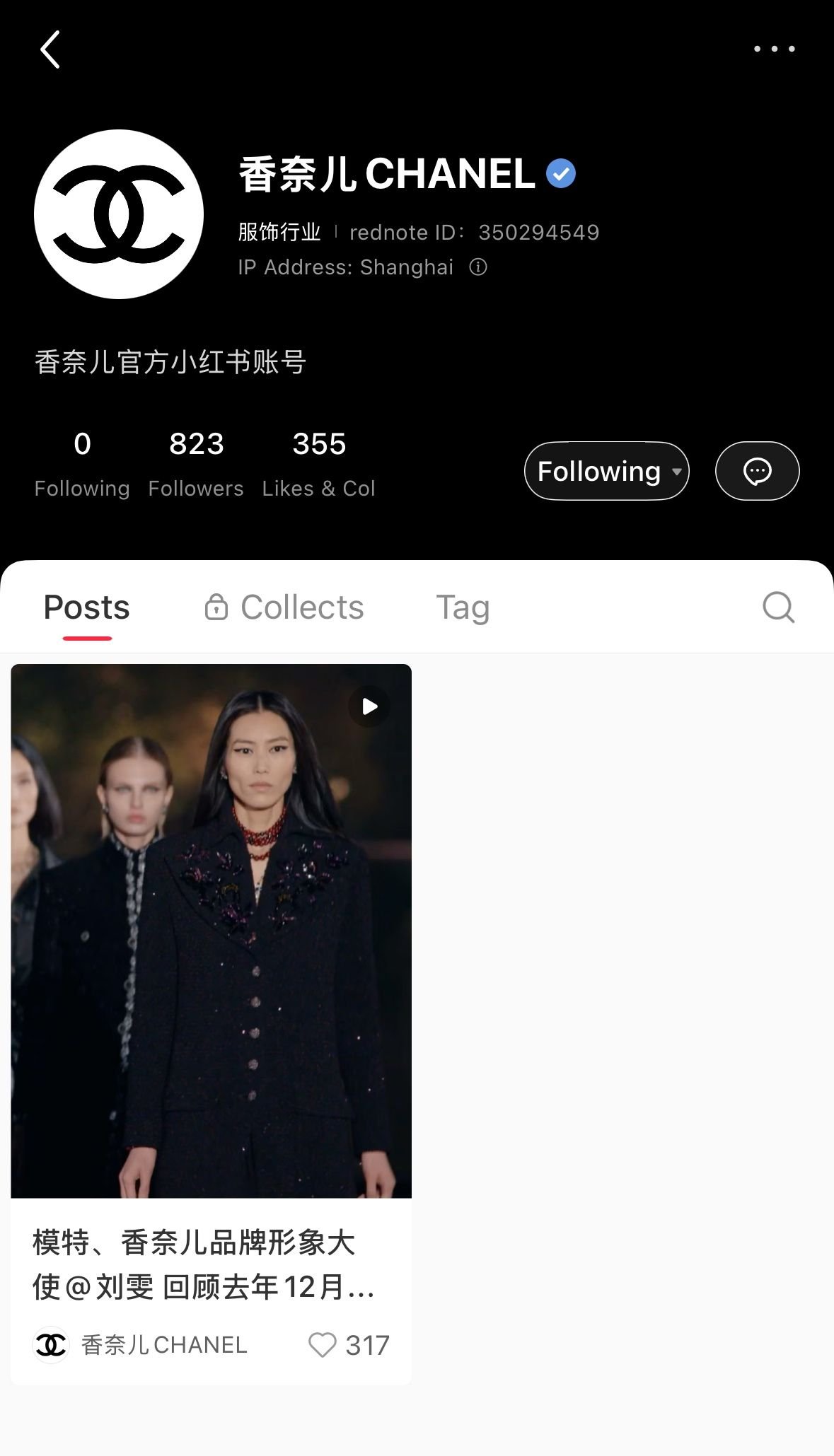

Chanel new social handle on Rednote (Xiaohongshu) launched on May 30, 2025

Chanel’s Digital Marketing Strategy in China

Strategic Platform Engagement

Chanel strategically engages with China’s unique digital ecosystem, tailoring its approach to platforms like Xiaohongshu, WeChat, Weibo, and Douyin:

Xiaohongshu: With over 200 million monthly active users, 89% female, Xiaohongshu is ideal for Chanel’s beauty and fashion campaigns. The platform’s lifestyle focus and UGC model allow Chanel to connect authentically with young, urban women.

WeChat: Chanel leverages WeChat’s Official Accounts and Mini Programs for exclusive VIP experiences, such as product drops and personalized consultations, fostering direct engagement with loyal customers.

Weibo: Used for broad-reaching campaign visuals and brand updates, Weibo targets a wider audience with polished content.

Douyin: Chanel taps into Douyin’s short-video commerce trend, which generated $483 billion in Gross Merchandise Volume in 2024, to engage younger consumers with dynamic content (Digital Crew).

Influencer and KOL/KOC Collaborations

Chanel’s strategy on Xiaohongshu relies heavily on partnerships with Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs). In 2022, Chanel led luxury brands with over 17,000 “zhongcao” notes—recommendation posts that “plant seeds” of interest—demonstrating its influence (Statista). KOCs, with smaller but highly engaged followings, drive 3x more engagement than traditional KOLs, making them cost-effective for building trust (AsiaPac Digital). Campaigns like “Coco Crush,” featuring K-pop star Jennie from BlackPink, blend celebrity influence with lifestyle content to appeal to Gen Z (Daxue Consulting).

Content Strategy

Chanel’s content on Xiaohongshu emphasizes storytelling, heritage, and craftsmanship, tailored to resonate with Chinese cultural values. Posts are visually stunning, showcasing products like Chanel No. 5 or Coco Crush jewelry in aspirational scenarios, and are timed strategically (e.g., 7–9 am, 12–2 pm, 9 pm–12 am) to maximize engagement. Behind-the-scenes content, such as runway shows or atelier glimpses, reinforces exclusivity while fostering emotional connections.

E-Commerce Integration

Chanel integrates e-commerce for beauty products via Xiaohongshu’s Mall feature and Tmall Luxury Pavilion, where it launched a flagship store in 2019 (Cosmetics Design Asia). The Tmall store offers real-time beauty advisor consultations and free shipping, replicating the in-store experience. However, Chanel avoids selling fashion and handbags online to preserve exclusivity and combat counterfeiting, a significant issue in China, where 73% of global counterfeit goods originate (Daxue Consulting).

Social Listening and Minimalist Engagement

Chanel employs social listening to monitor trends and consumer sentiment on Xiaohongshu, ensuring content relevance. Unlike brands with heavy interaction, Chanel maintains a “cool distance,” posting curated content that fuels desire while preserving its exclusive image. This approach aligns with luxury branding but requires careful balancing to engage Gen Z effectively.

Strategic Partnership: Xiaohongshu and Tmall Luxury Pavilion

The “Red Cat” partnership between Xiaohongshu and Alibaba’s Tmall Luxury Pavilion, launched in 2025, integrates Xiaohongshu’s lifestyle content with Tmall’s e-commerce infrastructure (Jing Daily). Merchants can embed product links from Tmall stores into Xiaohongshu posts, enabling users to transition seamlessly from content discovery to purchase on the Taobao app. This collaboration includes joint merchant accounts and performance dashboards, allowing brands like Chanel to track consumer journeys and monitor return on investment in real time (WWD). For Chanel, this partnership enhances its ability to drive traffic from Xiaohongshu’s engaged user base to its Tmall beauty store, boosting sales potential. The integration aligns with Chanel’s strategy of leveraging Xiaohongshu’s influencer-driven content to reach young, affluent consumers, particularly for beauty products.

Aspect

Details

“Redcat” partnership between Rednote and Tmall to boost ecommerce in China.

Partnership Name

Red Cat Plan

Key Feature

Embeds Tmall product links in Xiaohongshu posts

Benefits for Chanel

Drives traffic to Tmall beauty store, enhances sales

Tools Provided

Joint merchant accounts, performance dashboards

Impact

Boosts ROI for beauty brands by up to 150% (Alizila)

Potential for Chanel to Expand on Tmall Luxury Pavilion

Chanel’s existing Tmall Luxury Pavilion store, launched in 2019, focuses on beauty and fragrance, offering products like Rouge Coco Flash lipstick and Coco Mademoiselle perfume (Alizila). The Xiaohongshu-Tmall partnership positions Chanel to deepen its beauty offerings, leveraging Xiaohongshu’s 200 million+ users to drive traffic to Tmall. The partnership’s data-driven insights and seamless shopping experience could boost Chanel’s beauty sales by 20–30%, given Tmall’s reach to over 1 billion consumers and the 150% ROI increase reported for beauty brands (Alizila).

However, Chanel is unlikely to launch fashion or handbags on Tmall due to its commitment to in-store exclusivity and concerns about counterfeiting. While competitors like Gucci and Louis Vuitton sell fashion online, Chanel’s strategy prioritizes controlled distribution. If the partnership introduces robust anti-counterfeiting measures, such as blockchain authentication, Chanel might consider limited-edition fashion drops, but this remains speculative.

Impact on Luxury Brand Marketing in China

Chanel’s strategy on Xiaohongshu and Tmall reflects broader trends in luxury marketing:

Authenticity and UGC: Xiaohongshu’s community-driven model fosters trust, with 70% of users relying on it for product discovery (Acclime China).

Younger Audiences: Targeting Millennials and Gen Z, Chanel aligns with their values through sustainable packaging and diverse representation.

Social Commerce: The Xiaohongshu-Tmall partnership exemplifies China’s social commerce boom, driving sales through interactive experiences.

Counterfeiting Challenges: Xiaohongshu’s authentic reviews help Chanel combat fakes, reinforcing brand legitimacy.

Competitive Pressure: Competitors’ bolder digital tactics, like livestreaming, push Chanel to innovate within its beauty segment.

Conclusion

Chanel’s digital marketing strategy in China, centered on Xiaohongshu and enhanced by the Tmall partnership, balances exclusivity with modern engagement. The “Red Cat” initiative amplifies Chanel’s beauty e-commerce potential, driving sales through seamless content-to-commerce integration. While fashion remains offline, Chanel’s focus on beauty positions it to capitalize on China’s luxury market growth. As competitors embrace bolder digital strategies, Chanel must continue innovating to maintain its leadership.